How To Get Utmost Benefit And Maximum ROI With Your Outsourcing Firm

August 9, 2021

How To Hire Offshore Accountants from India – A Definitive Guide

August 24, 2021

Easily Outsourced Tasks For Your Accounting/CPA Firm

Accounting/CPA firms are often under pressure to submit their deliverables, they have to keep up with time to maintain a stable workflow in the firm, in the midst of all of this they also have to increase the results while lowering down the cost. According to Fortunly, 71% of financial service executives outsource or offshore some of their services while U.S. outsourcing statistics suggest that outsourcing in the financial services market will continue to rise by almost 7.5% annually. The BPO market is expected to reach $405.6 Billion by 2027 with a CAGR of almost 8.0%. Hiring in-house staff to manage daily accounting tasks can be challenging and costly so here are 6 accounting tasks that can be outsourced for your Accounting/CPA Firms.

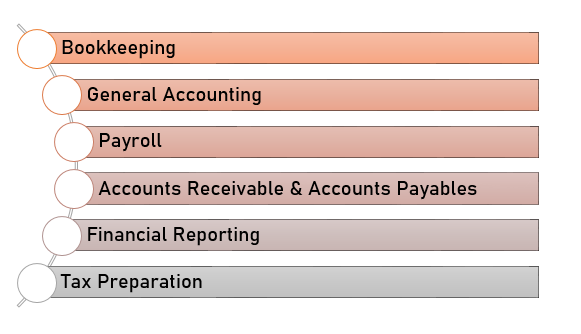

1) Bookkeeping:

Bookkeeping is one of the most basic but time-consuming tasks. It takes up most of your precious time, which can be used for core business. But it is easy to outsource the entire bookkeeping department. Hiring in-house staff for accounting can be expensive, on the contrary, you can outsource it and save the money to hire staff to perform complex accounting tasks.

2) General Accounting:

General accounting activities such as bank reconciliation, journal entry posting, accruals, and prepayments can also be outsourced. In this way, you can save your time and surely reduce the burden of tedious work on your accountant.

3) Payroll:

For small and medium enterprises, one of the most difficult tasks is to comply with mandatory laws, regulations and rules. The company may need to fully understand the laws and regulations to avoid any contravention. In particular, the compliance requirements related to payroll are often difficult to catch up and understand. Every business has employees so payroll is a must which in turn lead to payroll being most commonly outsourced task.

4) Accounts Receivables & Accounts Payables:

Repetitive financial tasks, such as accounts payable and accounts receivable, are generally outsourced to reduce the workload of overburdened business owners. Vendor setup, Purchase Order Processing, Vendor Report Reconciliation, Customer Setup, Revenue Reconciliation, and Cash Distribution can all be done by your remote team.

5) Financial Reporting:

Some complex accounting tasks, such as Managing Accounts, Commentary Analysis, Decision-Making and Planning Support, are also performed by a few outsourcing companies. This can help you avoid the burden of hiring in-house professionals, which are more expensive than outsourced professional teams.

6) Tax Preparation:

Paying taxes is an inevitable part of a business. You cannot evade tax obligations. Every company must pay taxes, but paying taxes and calculating taxes is not easy. This is why small and medium-sized companies are more willing to outsource their year-end taxes. These The company also provides specialized tax advice for corporate and individual tax filing throughout the year, so that everyone can easily pay taxes.

Conclusion:Any small and medium enterprise can outsource all these tasks to get the most benefit from outsourcing. These services can be handled professionally through virtual or remote assistance, and the cost of these services is usually lower than the cost of running these services internally by full-time or part-time employees. Therefore, outsourcing is available option for business owners.

We are ready to take over your outsourced bookkeeping and accounting tasks. We are committed to provide experienced accounting professionals for small and medium-sized enterprises to handle daily Bookkeeping, Accounting, and Special Accounting Projects. With an excellent record of satisfied clients and with prior experience along with our talented team, we are very happy to serve you.